Why to Choose Serpia

Your time is valuable, And so is your brand’s reputation. Serpia’s web‑based dashboard is designed from the ground up for clarity and collaboration:

Clean, Modern UI

Key metrics and graphs front and center.

Drill‑down filters for devices, locations, and search engines.

Upload or download up to thousands of keywords with a single click.

CSV templates and one‑step imports streamline your workflow.

Create “view‑only” links for clients—no need to hand over your login credentials.

Fast, informal chat for quick questions or troubleshooting.

In‑depth responses, knowledge‑base articles, and ticket tracking.

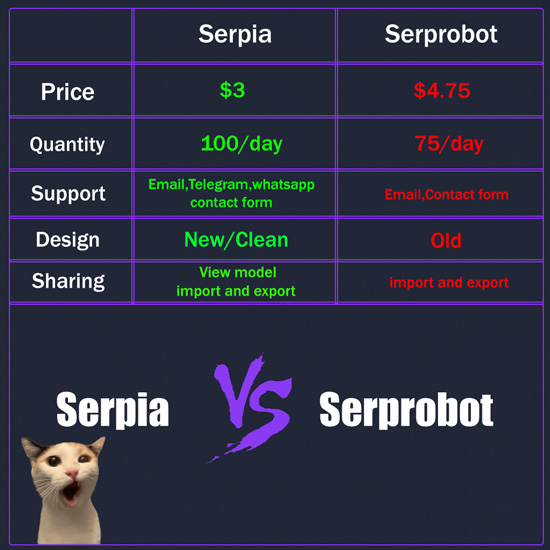

🟢 30 % More Keywords

🟢 40 % Lower Price

Comments Of SuperHeroes

We are starting our business, So there are not that much reviews for now. Let's See what Heroes are saying about us

"Super easy to use and quick to catch results. With great power comes great visibility—and this tool delivers both."

"I don’t waste time. This platform tracks rankings with the precision I need—efficient, silent, and always watching. Just the way I like it."

"Finally, a tool that puts me at the top where I belong. Fast, powerful, and absolutely unrivaled—just like me."

"Clear, reliable, and built to help—this platform makes sure nothing important slips through the cracks. Truth, justice, and great rankings."